Contents:

Here’s a general guide to understanding the different stablecoins available on the market today. Citizens of countries with unstable currencies can buy stablecoins instead of a currency that could plummet in value. Alternatively, top up your Binance cash wallet with other currencies to exchange the stablecoin of your choice. Binance is home to the world’s largest global cryptocurrency exchange by trading volume and user base. Central Bank Digital Currency is the digital form of a country’s fiat currency, which is regulated by its central bank. Since each individual’s situation is unique, a qualified professional should always be consulted before making any financial decisions.

what is covexs like Coinbase may offer some stablecoins, but such centralized exchanges may list fiat-backed versions only. For more options, you could use a decentralized exchange to swap any existing tokens for most stablecoins. Tokenomics refers to the token distribution of cryptocurrencies. Be wary of meme coins where a single entity controls a significant portion of the token’s total supply. Such digital assets are prone to experience a price slump if the major token holder decides to dump their coins. Therefore, it is advisable to go for a meme coin whose circulating supply is not concentrated among a handful of investors.

Because of their stable prices, stablecoins are useful in ways that other coins aren’t. Most notably, they’re the one type of crypto that could catch on as an actual currency. Sign up for a Binance accountto start trading stablecoins and other tokens today.

Fiat-Backed Stablecoins

And there’s always a chance that you could lose the private keys that give you access to your cryptocurrency, either through a hack or user error. Crypto staking, in which cryptocurrency owners can earn rewards by essentially lending out their holdings to help execute other transactions. Staking carries risks, however, so make sure you read up on the specifics for the coin you intend to use. The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

- On the Coinbase platform, eligible customers can earn rewards for every USD Coin that they hold.

- If you had put $1,000 in Bitcoin five years ago, you’d be sitting on over $70,000 now.

- It can even be another cryptocurrency, as long as it’s one which isn’t subject to huge price swings.

- The stable and efficient nature of fiat or gold-backed stablecoins inspires confidence in the crypto market.

- Additionally, the collateral is stored in an automated market maker pool providing liquidity for people to trade against, instead of sitting in a vault or lending pool.

Gemini was founded by Tyler and Cameron Winklevoss, well-known Bitcoin billionaires and tech entrepreneurs. Huobi is one the Asia’s largest cryptocurrency exchanges, founded in China and now operating out of Seychelles with offices in Singapore, Hong Kong, Japan, and the US. The HUSD is a stablecoin launched by Huobi through a startup called Stable Universal. The USD Coin was developed by the Centre consortium founded by Circle, a peer-to-peer payments company based in Boston, Massachusetts.

The History of Meme Coins

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace. Stablecoins continue to come under scrutiny by regulators, given the rapid growth of the $130 billion market and its potential to affect the broader financial system.

Keep in mind that it can take several business days for the transfer to process. You might also need to approve the transaction with your bank, as crypto exchanges can trigger banks’ fraud detection. The recommended way to do this is through a transfer from your bank account. Add your bank account as a funding source using the account number and routing number. Find an exchange you like, and then buy whichever stablecoin it offers. Do this if you’re open to whichever stablecoin follows the U.S. dollar.

USD Coin is a type of cryptocurrency that is commonly referred to as a stablecoin. Its name comes from the fact that you can always redeem 1 USD Coin for US$1.00, which gives it a stable price. On the Coinbase platform, eligible customers can earn rewards for every USD Coin that they hold. Temasek’s investment in Array comes just months after the collapse of one of the biggest crypto exchanges, FTX. Temasek, just one of the prominent investors in FTX, saw reputational damage after it was revealed that FTX was one of the biggest financial frauds in US history. NerdWallet strives to keep its information accurate and up to date.

A quick and efficient medium that lets crypto traders move fast in the crypto market

There are many similar regretful transactions in Ethereum’s history. Stablecoins solve this problem, so you can enjoy your pizza and hold on to your ETH. But with these investments from stablecoin issuers comes risk. On the other hand, decentralized stablecoins have revenue modes that vary from protocol to protocol. The first method stablecoin issuers use to make money is through the straightforward charging of redemption and issuance fees. TerraUSD was the biggest algorithmic stablecoin, reaching a market cap of more than $18.7 billion at its peak on May 5 before it began to plummet sharply after it slipped below its peg.

Many cryptocurrency adherents, on the other hand, believe the future belongs to digital tender not controlled by central banks. There are three types of stablecoins, based on the mechanism used to stabilize their value. Stablecoins give you a way to turn your cash into crypto without the volatility. This type of cryptocurrency is pegged to another asset and typically mirrors that asset’s value.

Unlike stablecoins such as Tether, Basis does not require its founders to hold reserves of US dollars. This is because the coin is pegged to 1USD in value, but isn’t actively backed by physical reserves. This enables it to be truly decentralised from fiat banks in a way that most fiat-backed cryptocurrencies cannot be. Fiat currencies, such as the U.S. dollar or the British pound, don’t see this level of price volatility.

Algorithmic Stablecoin

This states that the https://cryptolisting.org/ of a good or service is directly proportional to the amount of money that’s in circulation. It’s the same practice which most banks use to regulate inflation or deflation. And, of course, you can also use your USDC in the traditional sense to buy other cryptocurrencies. Referred to as “cold storage” or “cold wallets,” these physical devices can sometimes look like USB drives. You download your crypto from the web onto these drives and store them—Ledger and Arculus both support USDC.

Tether Grows 2.3% as Stablecoin Economy Loses $2.4 Billion in … – Bitcoin News

Tether Grows 2.3% as Stablecoin Economy Loses $2.4 Billion in ….

Posted: Tue, 25 Apr 2023 07:00:00 GMT [source]

As the price falls, users will be incentivized to sell their assets back to the pool. Volatility in Ethereum severely affected Dai’s stability in 2020. Dai is an Ethereum-based stablecoin managed by MakerDAO and developed by the Maker Foundation. The team was created by founder Rune Christensen in 2014 as a decentralized autonomous organization or DAO. The standards group is working with companies like Stablecorp to develop common standards that ensure stablecoins are accepted as a form of money and not considered securities.

Our young and dynamic team is comprised of well-known journalists as well as Cryptocurrency & Blockchain Experts. You can buy, sell or trade StableCoin on more than 10 exchange listed above. The total trade volume of StableCoin in last 24 hour is around 0 USD.

So another way to think about stablecoins is as a tokenized version of a fiat currency. In theory, a U.S. dollar-based stablecoin is a token that will reside on a blockchain and always trade for one dollar. Stablecoins are a type of cryptocurrency designed to maintain a stable price over time, pegged to the value of an underlying asset, like the U.S. dollar. They aim to offer all the benefits of crypto while attempting to avoid rampant volatility.

During the crypto market crash in May 2022, short selling by wealthy investment firms triggered panic selling by other investors as UST lost its peg to the dollar. This bank run created a “death spiral,” collapsing the value of both UST and LUNA in a matter of days. But the most catastrophic example of a stablecoin losing its peg has to be the story of Terra. An algorithmic stablecoin launched in 2018, Terra was a very popular project helmed by a capable team of experts and backed by major investors like HashKey Digital Asset Group and Huobi Capital. Gemini USD is a stablecoin launched by the Gemini Trust Company, a cryptocurrency exchange based in New York City.

Part of the Steemit network, SBD was designed to maintain its value at one dollar. The company maintains an all-cash reserve that matches the total valuation of all USDS tokens in an escrow account. Monthly audit reports are available to inspire investor confidence.

Accelerate your global growth with lightning-fast USDC payments that deliver instant cash flow. Access USDC liquidity to trade, borrow, lend, and invest across crypto capital markets. USDC makes the concept of settlement times obsolete with payments that can circle the globe and land in your account as fast as email. Imagine FX trades of any size that can take seconds to complete – that’s the power of USDC. Use stablecoin digital payments to send and receive funds globally. Unlike conventional US dollars, USD Coin does not require a bank account.

- Dai is an Ethereum-based stablecoin managed by MakerDAO and developed by the Maker Foundation.

- The startup behind the Steemit network eventually stopped managing the coin’s money supply and let the digital currency float freely.

- It’s easy to send USDC around the world, pay for goods and services, or save for the future.

- A more stable cryptocurrency is still decentralized, meaning it isn’t beholden to the rules and regulations of a centralized system.

- The value of most cryptocurrencies is largely determined by what the market will bear, and many people who buy them are doing so in hopes that they will increase in value.

Despite their low volatility, it’s still important to remember that any form of cryptocurrency is a risky investment. Always carry out your due diligence before buying into a fiat-backed, collateral, or algorithmic stablecoin. The stable and efficient nature of fiat or gold-backed stablecoins inspires confidence in the crypto market. Meaning more people are now more comfortable with engaging in the market.

Before we start detailing the key features to look out for in a credible meme coin, let us first define the concept of meme coin itself. Introduced in 2013, meme coins are usually crypto projects built around meme-worthy themes and animals. For instance, dogecoin , the first-ever meme coin, was inspired by the Shiba Inu meme sensation that swept the internet in the early 2010s. Before you go “aping” into the latest meme coin, here are a few tips on how to invest in meme coins safely. While Singapore’s Ministry of Finance wholly owns it, the conglomerate operates independently, with a portfolio worth over $400 billion. Altcoin) that is built to offer more stability than other cryptos.

One algorithmic stablecoin is AMPL, which its creators say is better equipped to handle shocks in demand. This group of cryptocurrencies is often supported with a reserve asset. Over the years, stablecoins have developed to be the most prominent and important class of cryptocurrencies. It must be noted that fiat and gold-backed stablecoins are far more resistant to such volatility.

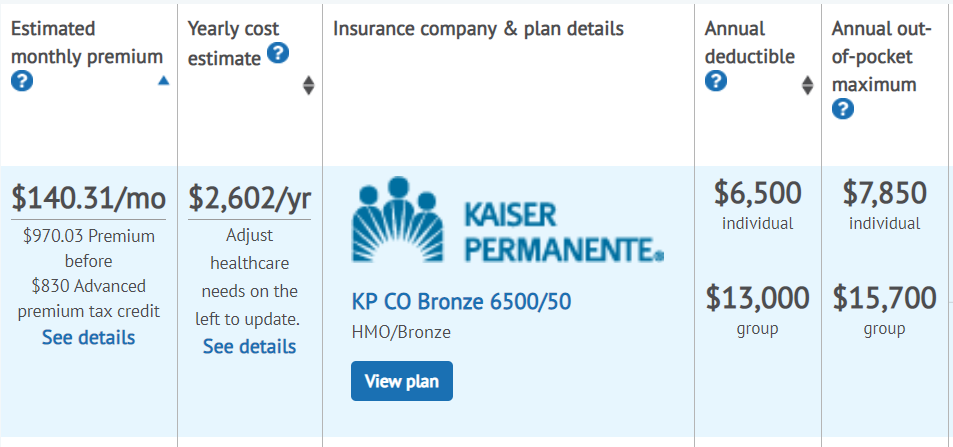

Privacy is also a major concern that many have around CBDCs and is an area that will need to be explored and addressed as digital currencies for widespread use by the public start to roll out. When buying USD Coin, factor in your financial goals and see if the risks make it the right buy for you. Increasing some transparency, accounting firm Grant Thornton audits those accounts and posts monthly draft attestation reports accessible to the public. That recent move now means either one dollar or asset-equivalent backs every USDC. Counterparty risk is the probability that the other party in the asset may not fulfill part of the deal and default on the contractual obligation. “Our journey towards increased transparency is not finished yet,” Paolo Ardoino, Tether’s chief of technology, stated in April, pledging he would continue to assure the market that Tether is dependable.

For example, an investor would likely exchange ETH for a new Ethereum-based coin on liquidity pools. To achieve this, the development team must provide liquidity. This is done by depositing both ETH and an amount of the meme coin in a liquidity pool. It is this liquidity that inventors would trade against to get their hands on the newly launched coin.

Stablecoin less preferable form of tokenized money, BIS paper finds – Cointelegraph

Stablecoin less preferable form of tokenized money, BIS paper finds.

Posted: Tue, 11 Apr 2023 07:00:00 GMT [source]

Put your stablecoin savings to good use and earn some interest. Like everything in crypto, the predicted Annual Percentage Yields can change day-to-day dependent on real-time supply/demand. A lot of exchanges and wallets let you buy stablecoins directly. Stablecoins are exchangeable for ETH and other Ethereum tokens. Demand for stablecoins is high, so you can earn interest for lending yours.

Its value is roughly a dollar and it’s accepted widely across dapps. Although not to the same extent as TerraUSD, investors worried about the reliability of reserves, and whether Tether was fully collateralized. The graph below shows USDC’s collateral reserves as of August 2022—at $54 billion, the coin’s reserves are slightly greater than its liabilities of $53.8 billion.

However, the risk level for stablecoins is greatly influenced by its backing. That is why several digital currency projects have taken a new approach. Instead of replacing traditional money, they’ll work alongside it. “Stable cryptocurrencies” peg themselves to a fiat currency, typically the dollar, and automatically adjust the number of tokens in circulation to keep the price stable.